Attracting investors and convincing them to adopt and invest in a business idea is one of the most prominent challenges entrepreneurs face.

You might have an innovative idea and a solid business plan, but without successfully convincing investors and securing the proper funding, these dreams remain just ideas on paper. However, with an effective funding strategy, these ideas can be turned into a tangible reality, building successful and sustainable businesses.

We present a concise and comprehensive guide to everything you need to know about project finance and how to attract investors to achieve your desired funding goals.

But first, let us shed light on the startup landscape in the Middle East.

The State of the Startup Market in the Middle East in 2023

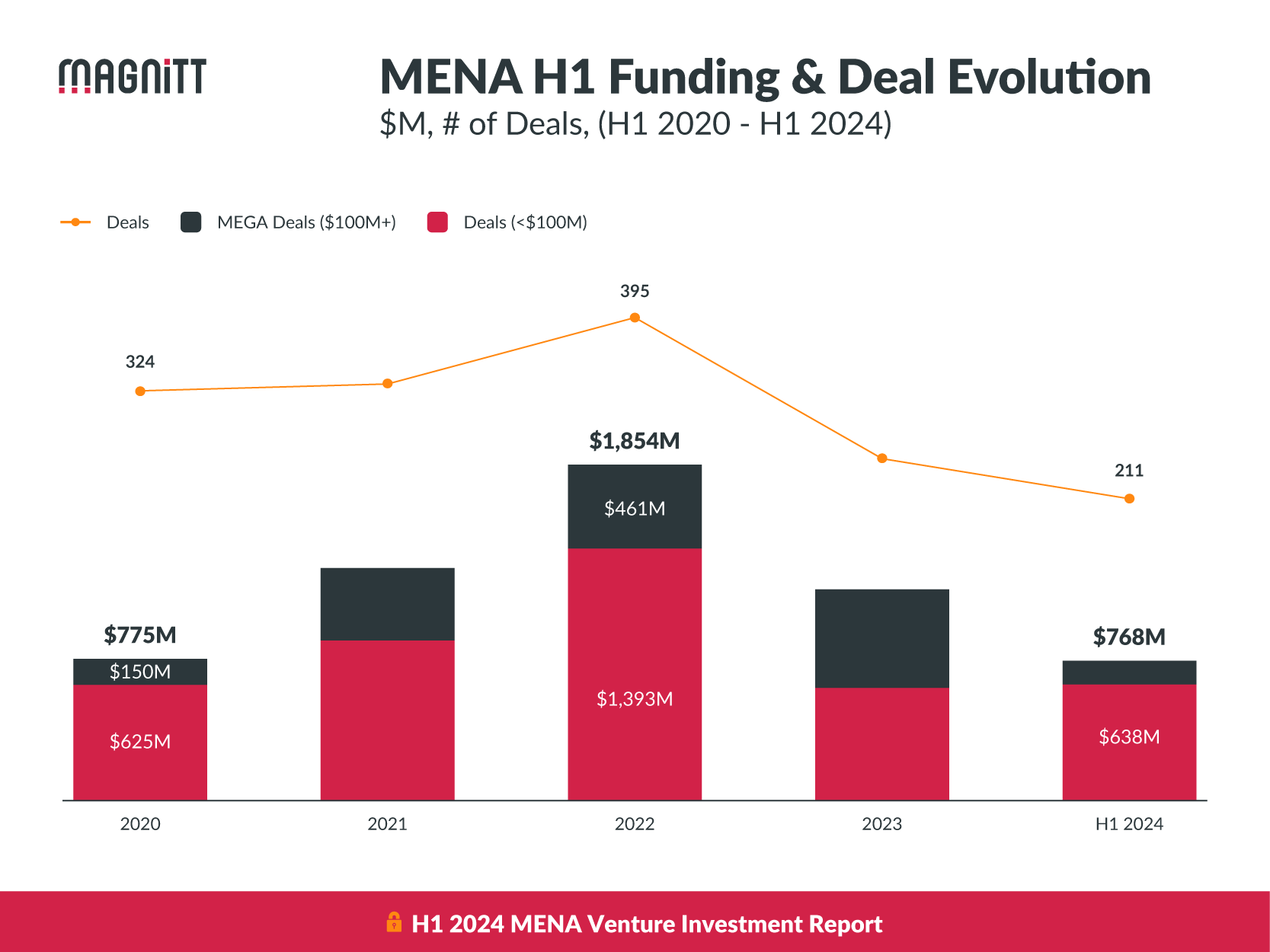

According to a recent report by MAGNiTT, the venture capital (VC) ecosystem in the Middle East raised $768 million across 154 deals during the first half of 2024.

Despite this being a 34% YoY decline in funding, the UAE and Saudi Arabia remained the most active in the field.

Saudi Arabia secured significant funding through two major deals in the e-commerce and modern retail sectors:

- SallaApp closed a substantial deal worth $130 million.

- Rewaa secured an investment round worth $75 million.

Additionally, the top-funded sector in H1 2024 was E-commerce/Retail, securing $244 million in total funding despite a 39% YoY drop.

Key Highlights from the Report

- Increase in Investor Participation: The number of investors in MENA rose by 30% YoY to 262, indicating strong and sustained interest from both regional and international investors.

- Shift in Deal Dynamics: Excluding MEGA deals, non-MEGA funding in H1 2024 saw a 3% increase compared to H1 2023, driven by a 48% QoQ increase in non-MEGA deal funding in Q2 2024.

- Sector Trends:

- E-commerce/Retail: Dominated by major deals like SallaApp’s $130M and Rewaa’s $75M investments.

- FinTech: Leading in deal count but saw a decline in funding due to the absence of MEGA deals.

Noteworthy Insights

- Investor Growth: MENA saw a notable rise in investor participation, with a 30% YoY increase to 262 investors.

- Regional Focus: 36% of investors were headquartered in KSA and UAE.

- Funding Distribution:

- 45% of deals in the $1M-$5M range, indicating a preference for mid-sized investments.

- Smaller deals under $1M accounted for 38%, while larger deals ($5M-$20M and $20M+) made up 14% and 3% respectively.

- Top Investors:

- Sanabil Investments: $57.3M

- Investcorp Bahrain: $55.7M

- STV: $25.2M

- Leading in deal count: 500 Global (16 deals), Antler (11 deals), and +VC (10 deals).

Comparative Analysis

- Non-MEGA Deal Funding Growth: MENA is the only region to report growth in non-MEGA deal funding in H1 2024, with a 3% increase compared to H1 2023.

- Global Trends: In contrast, SEA and Africa experienced significant declines in non-MEGA deal funding by 37% and 55% respectively.

Market Resilience

Despite the overall downturn, MENA’s venture capital landscape showed resilience with year-over-year growth in non-MEGA deal funding, driven primarily by the strong performance in Saudi Arabia and the UAE.

Now, let’s delve into the main topic of this guide.

What Is Project Finance?

Project finance is obtaining the necessary financial resources to start a new business venture or develop an existing project. These financial resources typically come from various sources and aim to enable project owners to achieve their business objectives.

The Key Project Finance Funding Sources and Options

In KSA and the UAE, you can secure funding for your business project from various sources, depending on its nature and size.

Here are the primary sources through which you can obtain project finance:

- Commercial Banks like large international banks, regional banks, and local banks like smaller banks with local expertise.

- Development Banks and Financial Institutions like the Social Development Bank in Saudi Arabia and the Emirates Development Bank (EDB) in the UAE.

- Institutional Investors like Sovereign Wealth Funds such as the Public Investment Fund (PIF) in Saudi Arabia.

- Private Equity firms invest in projects by providing capital in exchange for ownership stakes, and Venture Capital firms, which provide funding for high-risk, high-reward projects, particularly in innovative or emerging sectors.

- Corporate Investors like Strategic Investors are companies investing in projects aligned with their strategic interests, such as energy companies investing in new power plants—and Joint Ventures where companies pool resources and share risks and rewards.

- Government and Public Sector, such as Public-Private Partnerships (PPPs) and collaborative agreements between government entities and private sector companies to finance, build, and operate projects.

- Capital Markets such as Project Bonds and debt securities are issued to raise funds for specific projects. It also includes Securitization, which means converting project cash flows into securities sold to investors.

- International Organizations like the United Nations, NGOs like the European Union, and various UN agencies that fund projects aligned with their missions, such as environmental or social initiatives.

- Specialized Project Finance Companies with deep expertise in financing specific industries, offering tailored financial solutions for large-scale projects.

What Types of Projects Need Funding?

There are many types of projects that require funding to achieve their goals and execute their plans, including:

-

Startups

Small companies in their early stages seek to offer new and innovative products or services. They need funding for research and development, marketing, and team expansion costs. Often found in sectors like technology, health, and agriculture.

-

Small and Medium Enterprises (SMEs)

Companies operating on a relatively limited scale but significantly contributing to the local economy. These projects range from small shops and restaurants to service companies like beauty salons and travel agencies. They need funding to expand operations or improve services.

-

Large Enterprises

Large industrial companies include car manufacturers, electronics factories, and power plants. These projects require significant funding to cover high production costs, research and development, and infrastructure expansion.

-

Social Enterprises

Projects focused on achieving positive social impact alongside profits. They include initiatives in education, public health, and the environment. These projects need funding to implement their community programs and expand their influence.

-

Real Estate Projects

Real estate development projects, such as building residential complexes, and investment projects, like purchasing and renovating properties for sale or rent, require substantial funding to cover construction or purchase and renovation costs.

These projects require funding for specific reasons: covering initial costs, expanding business operations, or developing new products and services.

اشحن طلباتك الآن مع أكثر من ٢٠٠ شركة بأسعار مخفضة

Essential Steps to Attract Investors and Secure Funding for Your Project

To illustrate the process more clearly, let’s assume you have a business project centered around:

An online store specializing in producing certain types of grocery and food products for consumers who follow a specific diet free of fats or sugars, offering a subscription-based delivery service weekly or monthly via an app.

Now, you want to attract investors to secure funding for your project. Here are the steps to follow:

1. Prepare a Strong Business Plan to Attract Investors

A business plan acts as a roadmap for your business project and is crucial in convincing investors of your project’s viability and potential for growth and profitability. Preparing a solid business plan requires considering the following elements:

- Executive Summary: Includes a brief overview of the project and its innovative idea, main objectives, competitive advantage, expected demand for the product or service, and the business model.

- Project Description: Provides a detailed explanation of the project idea and product or service details, analysis of the target market, market size and characteristics, competitor analysis, and marketing strategies to reach customers.

- Operational Plan: Outlines the necessary infrastructure for the project, required human resources and skills, daily operations management, and contingency plans for unexpected challenges.

- Financial Plan: This plan includes expected costs for establishing and operating the project, available funding sources (loans, investments, self-financing), financial projections (revenues, expenses, profits), and economic feasibility analysis.

- Marketing Plan: Covers pricing strategies for the product or service, distribution channels, advertising and marketing campaigns, and marketing goals and metrics for evaluation.

The business plan should be clear, concise, and easy to understand, supported by accurate and reliable numbers and calculations. Be optimistic about the project’s future but realistic in assessing challenges.

2. Identify Your Funding Needs

Accurately identifying your funding needs is essential to attract investors and secure financing for your business project. This step requires a thorough and realistic analysis of the funds you need and how to use them to achieve project goals. This entails:

- Assessing the Current Situation: Before determining your funding needs, evaluate your project’s financial situation, including analyzing current cash flows (revenues and expenses) and evaluating assets and liabilities.

- Setting Goals: Identify the goals you aim to achieve with the funding, such as increasing production capacity, expanding into new markets, developing products, raising brand awareness, attracting more customers, hiring new employees, or training existing ones to enhance efficiency.

- Estimating Costs: Once goals are set, calculate the associated costs, including rent, salaries, raw materials, marketing, equipment purchases, and construction costs.

- Preparing a Detailed Budget: Create a budget to clarify how the funds will be used, including expected revenues, expenses, and net profit.

- Determining the Required Amount: Based on the detailed budget, choose a realistic and reasonable amount that fits the project’s size and goals.

3. Research Investors

This critical step involves identifying investors whose visions and values align with yours and who can provide financial support. Understand the type of investors needed for your project, whether they are angel investors, venture capital firms, or crowdfunding.

Study these investors’ backgrounds and track records in funding similar projects to ensure their goals and strategies align with your business objectives.

4. Prepare a Professional Presentation

The presentation is your company’s front line to investors and a golden opportunity to convince them of your project’s viability and growth potential. Therefore, it should be meticulously prepared, combining strong content and attractive design.

Here are some tips for creating a solid and appealing presentation:

- Highlight Market Size and Potential: Provide data showing the expected demand for your product or service.

- Showcase Your Competitive Edge: Detail what sets your business apart, such as competitive pricing, product quality, or fast delivery.

- Introduce Key Team Members: Present the critical team members and their relevant experience and achievements, instilling confidence in your ability to execute the business plan.

- Organize Logically: Start with an overview of your business idea, followed by detailed explanations of your product or service, target market, competitive analysis, marketing strategy, and financial projections.

- Use Visual Elements: Incorporate charts and graphs to illustrate critical data and trends, enhancing understanding and making your presentation more engaging.

- Clarify the Problem and Solution: Clearly explain the problem your project addresses, the solution you offer, and the potential impact, using simple language and avoiding technical jargon.

- Provide Realistic Financial Projections: Present well-supported financial forecasts showing your project’s growth potential, using tables to display vital financial data such as sales forecasts, profit margins, and return on investment.

- Prepare for Questions: Anticipate potential questions from investors and prepare thoughtful and reasonable answers. Be ready to address any concerns or objections raised during the presentation.

By crafting a compelling investor presentation, you can convincingly present your business idea, helping secure the necessary funding to start or develop your business and achieve your desired goals.

5. Negotiate and Close the Deal

Negotiation is a crucial stage in attracting investors. It bridges the gap between entrepreneurs’ ambitious visions and investors’ willingness to invest. During this phase, parties exchange views on investment terms, determine the company’s fair value, and distribute shares.

Negotiation requires strong communication and persuasion skills, along with a deep understanding of mutual needs and interests. Entrepreneurs should be prepared to make some concessions to secure the needed funding while safeguarding the company’s long-term interests.

Closing the deal, culminating in lengthy negotiations, involves turning the preliminary agreement into a legally binding investment contract. This process includes:

- Preparing Contractual Documents.

- Securing Agreed Shares.

- Transferring Funds.

Entrepreneurs should work with lawyers and financial experts to ensure all conditions are correctly implemented, setting the stage for achieving investment goals, expanding operations, and ensuring sustainable growth.

Congratulations, you’ve found the right investor! But the crucial question now is:

Do You Have to Pay Back What I Got as a Project Finance?

Whether you have to pay back what you receive as project finance depends on the financing you obtain. Here’s a brief overview of the repayment obligations associated with different types of project finance:

Types of Financing and Repayment Obligations

- Debt Financing

- Loans: You must repay the principal amount plus interest over the loan term.

- Bonds: You must repay the bond amount plus interest to bondholders.

- Equity Financing

- Equity Investments: No, you don’t repay equity investors directly. Instead, they receive a share of the profits and ownership of the project.

- Mezzanine Financing

- Hybrid Debt-Equity: Yes, it often involves repayment, but terms may include converting debt to equity if not repaid.

- Grants

- Government/Organization Grants: No, grants do not need to be repaid but often come with conditions or requirements for their use.

- Venture Capital

- VC Funding: No, venture capital is a form of equity investment, so it doesn’t require repayment but involves giving up a share of ownership and profits.

- Public-Private Partnerships (PPPs)

- PPPs: It depends on the specific agreement; usually, the private sector partner invests and recoups costs through project revenues.

- Crowdfunding

- Donations: No repayment required.

- Reward-based: No repayment, but you provide rewards or products in return.

- Equity Crowdfunding: No repayment; investors get equity shares.

- Debt Crowdfunding: Yes, repayment with interest is required.

Does a Business Idea Need to Be Innovative to Get Funding?

It’s not necessarily required for a business idea to be innovative to secure funding. Still, certain elements and factors must be present to make the idea attractive to investors and increase the chances of obtaining the necessary financing to start or develop your project. These include:

- Clarity: The idea should be clear and easy to understand. Investors prefer ideas that they can quickly grasp without needing complex explanations.

- Feasibility: The idea must be practical and executable, with a clear plan for turning it into a tangible product or service.

- Market Need: The project idea should address a real problem or fulfill an existing market need. Investors look for ideas that offer solutions to issues people or businesses face.

- Innovation and Uniqueness: While not always required, an innovative idea offering something new or improving upon what’s currently in the market can make it more attractive and distinctive than competitors.

- Scalability: The idea should have the potential to expand and grow. Investors favor ideas that can quickly scale to new markets or different sectors.

- Market Trends: The idea should align with current and future market trends. Investors prefer ideas that match the changing market directions and needs.

- Development Potential: The idea should be capable of evolving and improving over time, ensuring it continues to add value and meet changing market needs.

- Competitive Advantage: The project idea should have a competitive edge that allows it to outperform competitors, whether it’s through superior product quality, competitive pricing, or advanced technology.

- Sustainability: The idea should be long-term sustainable, with operational plans and flexible strategies that allow it to easily adapt to future changes.

In addition to these components, it’s essential to have:

- A Clear Business Model: Explain how the project will make money, the target audience, and how to reach them.

- A Strong and Qualified Team: A capable team can execute the project idea effectively and achieve the desired goals, increasing investor confidence.

- A Comprehensive Feasibility Study: This should cover all aspects of the business idea, including market analysis, competition, costs, revenues, and potential risks.

- Commitment and Seriousness: Investors seek severe and committed entrepreneurs determined to succeed. Show that you are prepared to work hard to meet project goals.

- Transparency: Be honest about the project’s potential risks. Investors appreciate transparency and want to know how you plan to handle potential challenges.

It’s also important to note that securing project funding is not easy and is often filled with obstacles and challenges that businesses must navigate to obtain the necessary financing.

Significant Challenges in Project Financing and Solutions to Overcome Them

Project financing involves numerous challenges impacting a project’s success and sustainability. Here are some of these challenges and ways to overcome them:

1. Difficulty in Securing Funding

Securing funding from banks and financial institutions is one of the biggest challenges business projects face, especially in their early stages. Many institutions require substantial collateral and a good credit history, which new entrepreneurs may not have. Startups struggle to attract funding due to the high risks involved, making investors hesitant to provide financial support.

This challenge isn’t limited to banks; even individual investors, such as angel investors or venture capitalists, can be cautious about funding new projects, basing their decisions on factors like business plans, founding teams, and target markets.

To overcome this challenge, project owners should present solid and convincing pitches to attract the necessary funding and consider:

- Crowdfunding: Use platforms like Kickstarter and Indiegogo to raise the necessary investments.

- Self-Funding: Utilize personal savings or current assets for temporary financing.

- Borrowing from Friends and Family: Secure temporary loans with clear, documented agreements to avoid future disputes.

2. High Cost of Capital

Another challenge is the high cost of capital, which increases financial burdens on the project and can weaken its competitive edge and success. High loan interest rates make it difficult for small and startup projects to generate enough profit to cover financing costs, potentially leading to long-term liquidity issues.

To address this problem, consider:

- Low-Cost Financing Sources: Seek funding from banks with low interest rates or government programs supporting small businesses.

- Renegotiating Loan Terms: Negotiate to lower interest rates or extend repayment periods.

- Equity Financing: Sell part of the equity to investors instead of taking on debt.

3. Economic Fluctuations

Economic fluctuations pose significant obstacles to various business activities, causing market instability that affects the ability to attract funding and maintain market presence. Financial crises like recessions or inflation can heavily impact consumer behavior and spending capacity, negatively affecting company revenues.

To mitigate this challenge, consider:

- Diversifying Funding Sources: Reduce the impact of economic fluctuations by having multiple financing sources.

- Maintaining Adequate Savings: Keep sufficient reserves to weather economic crises.

- Flexible Financial Planning: Develop financial plans that account for different economic scenarios.

- Investing in Crisis-Resistant Products and Services: Focus on essential products with stable demand even during economic downturns.

By addressing these challenges with strategic solutions, business projects can improve their chances of securing funding and achieving long-term success and stability.

The Importance of Securing Funding for Business Activities

Securing the necessary funding plays a pivotal role in business activities’ success, sustainability, and competitive value. It offers several benefits, including:

1. Covering Operational Expenses

Obtaining funding helps cover daily operational expenses such as wages, rent, and utility bills, which are essential to keeping the business running smoothly. Ensuring adequate financing for these expenses prevents work stoppages or disruptions due to cash flow shortages, contributing to business stability and continuity.

2. Growth and Expansion

Funding enables companies to grow and expand. With sufficient financial resources, a company can invest in product development, enter new markets, or improve its operations to increase efficiency. Financing allows businesses to broaden their scope and increase long-term returns.

3. Enhancing Competitive Capability

With the help of funding, businesses can enhance their competitive capabilities by investing in areas such as marketing, quality improvement, logistical efficiency, and employee training. These investments allow firms to offer better products or services than their competitors, leading to improved competitiveness, increased market share, and higher profits, contributing to the company’s long-term sustainability and growth.

Conclusion

Project financing is the backbone of achieving economic growth and development. It is not merely about providing funds; it is a strategic process that requires careful planning and continuous monitoring to achieve desired goals. By leveraging available funding sources and applying best practices in money management, projects can thrive and contribute to sustainable development.

Success in project financing relies on securing financial resources and effectively and efficiently managing these resources to maximize their benefit, thereby enhancing competitive value and achieving profitability.